How To Benefit From The Unseen Margins

5 Key Tips For Success

These Unseen Margins Can Have A Very Dramatic Impact On Your Life

To understand how to benefit from the unseen margins we need to start by understanding what they are and where we find them.

These unseen margins contain hidden value that can have a very dramatic impact on your health, wealth and overall well-being.

But to realise these benefits does require a different way of thinking. In this article I am going to explain:

- What Unseen Margin Is And How To Measure It

- Where To Find Unseen Margin In An Environment Of Complexity

- 5 Key Tips To Benefit From Unseen Margin

- Guiding Principles To Benefit From Unseen Margin

You will see that some of the illustrations and quotes I have used in the first section are heavily business oriented.

This is partly because much of the literature on this subject has come from the business world and partly because I am a businessman and that is my world!

I have broadened the scope as the article progresses to explore how to benefit from the unseen hidden margins in any area of life and to provide real life illustrations of this in practice.

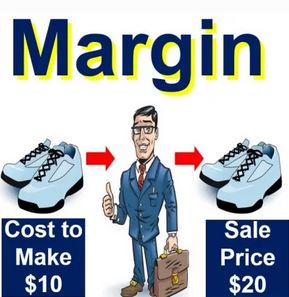

[1] Margin - Types: Tangible & Intangible A margin is the gap or space between 2 things. In

the business sense, margin is the difference between the acquisition cost or the

production cost of an item or activity and the price at which you can

sell it.

But in the wider interpretation, margin can be expressed in a number of

different ways; here is my working model for how to benefit from the

hidden margins.

Tangible and Intangible Margin [a] Margin can be tangible and refers to things that can be easily seen and quantified. [b] Margin can be intangible and refers to things that are not immediately obvious or visible and are hard to quantify.

How To Benefit From The Unseen Margins - Defining Our Terms

Our focus is on intangible margin because that's where the big benefits are to be found.

[2] Metrics - Primary and Secondary Currency

Primary and Secondary Currency

The next point to consider as we

explore how to benefit from the unseen margins is how we measure these

margins - what currency do we use?

Currency is the metric of the value of a margin and is determined by:

- Tangibility

- Measurability

- Visibility

Currency is the expression of the value of a margin

By way of analogy think of this in terms of power.

Think of the hard power exercised by politicians and organisational leaders which is objective in the sense that is visible, tangible and measurable in terms of facts, figures and money.

Think of hard power as an analogy for primary currency.

The currency or expression of hard power is coercive and based on the rule of law and threat of punishment for non-compliance.

In contrast, consider soft power. At time of writing, here in the UK we have spent the past 10 days mourning the death of our queen, Queen Elizabeth II.

One of the many strengths that many commentators attributed to her majesty was the exercising of soft power both within the British political system and on the global stage.

The measure of soft power is value and the currency or expression of soft power is relational and based on a high level of inter-connectivity and subtle indirect persuasion.

We can think of this as an example of secondary currency.

The benefits of soft power can be hard to quantify and express in the short to term. It is often only visible over the medium to long term, or after the person exercising it has moved into another role or has died.

For the purposes of this article, and to clarify our understanding of how to benefit from the unseen margins, we will think of how we measure and express the value of margins as follows:

- Primary currency = facts, figures and money, and is an objective measure.

- Primary currency can only be applied to tangible margins i.e. that which can be seen and measured.

- Secondary Currency = anything that has high perceived non-monetary

value and importance to a specific individual or group of individuals, and therefore is subjective.

- Secondary currency is applied to intangible margins and is hard, and often impossible, to see and can only be measured by those in receipt or possession of it. Because it is based on value, it is subjective.

Examples of secondary currency are:

- Reputation

- Trust

- Honour

- Recognition

- Respect

- Influence

- Space

- Freedom

- Peace of mind

- Transfer of intangible assets such as skills, knowledge and intelligence/information

There is a very interesting and profitable interplay between primary and secondary currency and how one can be leveraged to greatly increase the other. We will go into this in more depth below and I will share some personal illustrations.

As a brief example for now, consider this quote from Warren Buffet about how Costco take primary currency in the form of profits and transmute it into secondary currency in the form of trust - which in turn will generate enhanced primary currency/profits in future.

Kris Abdelmessih in "Working For Free" talks about CostCo's strategy and comments:

'It’s not as hokey as it sounds. Think of it this way. They are

hiding profits in the customer’s own pockets. They will be return

customers. That profit is hidden from competitors’ wandering eyes and

the IRS. The strategy commits Costco to keeping the customers happy

because the profit is realized over the long-term. It’s simple but

requires rare discipline.

The profit that “sits in

your client’s pockets” has a bookkeeping entry called “trust”. The fact

that it doesn’t capitalize as an asset on your personal balance sheet is

a shortcoming of accounting. You can’t let it fool you from the reality

that you have stored your future income with your clients and in their

word of mouth.'

Our focus is on understanding, identifying and

leveraging secondary currency because that's where the big primary

currency benefits are to be found. We are also going to pay

close attention to the relationship and interplay between primary and

secondary currency and note how some people get confused and as a result

make significant losses.

[3] Visibility = Margin Type + Currency

Visibility of margins is inextricably linked to measurability.

Tangible margins are measured in primary currency and have high visibility.

The unseen margins that we are seeking to identify and benefit from are intangible and hard to measure because value is subjective.

To reframe the popular Platonic phrase:

"Value is in the eye of the beholder."

We have to know:

- What to look for

- Where to look for it

- How to benefit from it

I want to wrap up this first section with this wonderful quote from Charlie Munger expressing his frustration at trying to do this:

We have to know where to look for

these intangible margins, how to position ourselves to find them and

how to apply some very simple questions that will help us learn how to benefit from the unseen margins.

But before we address these challenges we need to take a brief look at

the environment and some of the key factors that will point us in the

right direction.

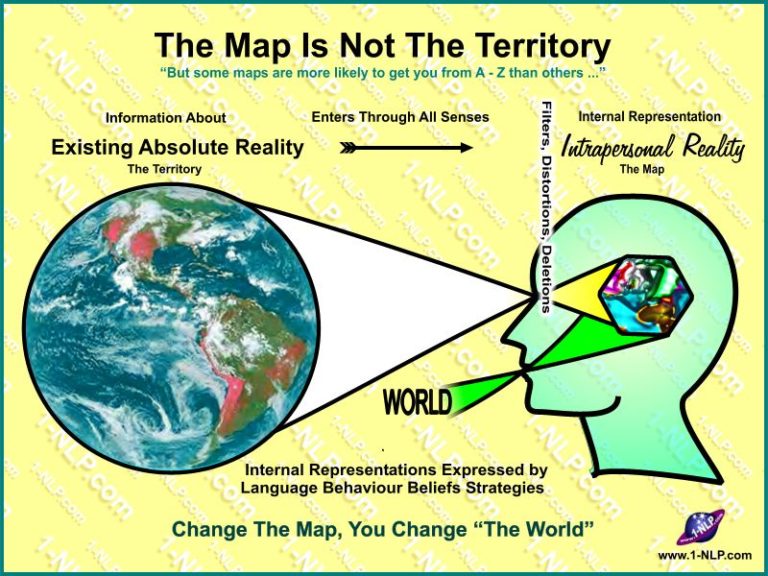

[1] Gaps Between The Map And The Territory We live in a very complex world and the scale of it all is beyond human cognitive capacity. There is just way too much of it for us to hold it all in our heads so we create maps of all this complex territory and use heuristics and mental models to understand and apply some of the principles of how things work. But the maps [or models] that we create can become disconnected from the on the ground reality. This is illustrated in point two below.

Sometimes a gap

emerges between the map and the territory. These gaps between the map and the territory are fertile hunting ground for unseen margins.

[2] Top-Down Over-Simplification

This is about the imposition of a simple idealised solution onto a complex situation or system. This is a classic illustration of a very common disconnect between map and territory. Governments

are particularly bad at this and do not know how to benefit from the

unseen margins. They can not see them because they can not measure them.

Governments [in common with many other large organisations] come up with

new initiatives and policies that are hopelessly out of touch with the

on the ground realities but demand hours and hours of time from those in

the front line. # A UK example of teachers and doctors As

an example, here in the UK I have a number of friends and contacts who

are teachers or medical practitioners and they are overburdened with the

amount of time taken on filling in forms to comply with the

Government's insatiable desire for data. There is - certainly

here in the UK - the ill-founded belief that if you can see it you can

measure it, and if you can measure it you can improve it. This

leads to an obsession with performance league tables and overlooks all

the many areas where the benefits of teacher/doctor care and attention

are hidden and because they are not seen they can't be easily measured. This

also leads to the converse being true. Because those things that are

not seen and measured are overlooked two other important factors come

into play, and these are inter-related: [a] the passage of time and [b]

second order consequences. In this example, after the passage of a few years, the second order consequences kicked in as teachers and doctors retire early and/or leave the professions. # A German example of not seeing the wood for the trees Taylor Pearson

gives a wonderful example of this with the true story of how in the late 18th Century the German

government

decided to modernise its forestry.

Applying the principle that margin existed where you could see it and

measure it they transformed their forests with typical Germanic

efficiency. One of the major side effects of all this was the removal of all the foliage and underbrush from the forest floor. The

results, over the decades following these improvements, was a

significant uplift in revenues and the German state looked on what it

had created and decided that it was good... until the next

generation of plantations came to fruition and the yield was appalling. To

cut a long story short they discovered that the removal of all the

underbrush and associated detritus had deprived the soil of all its

nutrients. As Taylor Pearson explains: "The forestry example is useful because it contains all the elements critical for understanding legibility/visibility: Well-intentioned

outsiders looks at a complex system, finds it confusing (because it’s

illegible/unseen), and thinks they can improve it. They come up with an

idealized way that the system should

work, and then use their power and authority to impose that simple,

idealized vision on a complex reality. In the short

term, everything

seems to get better as a result, they are widely praised, and then down

the line catastrophe strikes and everything comes crashing down." All too often top-down over-simplification works in the short term but fails in the long term because

of unforeseen and unacknowledged

second order consequences. Wherever you see or experience

top-down over-simplification there will always be opportunities to

discover and exploit unseen margins.

[3] Cause And Effect in The Passage Of Time Put simply the longer the passage of time the harder it is to see the hidden margins. Cause and effect is hard to establish, let alone see, over a 10-20 year span unless you know what to look for. # Cause and effect in organisations In

my experience the place to look for cause and effect in organisations

is in their culture because it determines how people behave within a

group context. Culture is [in my experience] the single biggest

determinant of how an individual will behave

within an organisational environment. It is the invisible software that

determines how an organisation will perform over the

long run. Culture will over-ride education, intelligence and common

sense. Many times I have seen otherwise very bright people do some

really stupid things because the dominant corporate culture dictated it. One

major IT company I used to contract/consult with was a systems

integrator handling large multi million dollar projects. Invariably

there were tensions and conflicts between client and supplier. This

company had a culture of non-confrontation. They had no real sense of

boundaries and would always give in to unwarranted demands and claims

from the client rather than push back. I realised this early on

and saw a hidden margin I could and did exploit to the company's and my

own advantage by challenging the client and pushing back. I gained a reputation as a trouble shooter and was very highly paid for my ability to get things done. If you can get a handle on the corporate culture you will spot opportunities to exploit unseen margins.

# Cause and effect in individuals At

the personal level the compounding effects of doing enough of the

"right" things - in short, having the right habits - will lead to

astonishingly large rewards over the long term James Clear has spoken in depth and detail about the importance of what he calls atomic habits which are comprised of small

and seemingly insignificant changes that will compound into remarkable

results if you persist with them consistently over many years. Clear

also makes the point that in the modern world we live in a "delayed

return environment" where the ability to accept deferred gratification

is critical, but we are hard wired for instant gratification.

This is one area where any of us can learn how to benefit from the unseen margins of good habits.

When it comes to other people pay very close attention to their behaviour and their actions. I

have learned the hard way over many years in business to listen to what

people say and watch very carefully how they behave over a period of

time and then and pay close attention to the disconnects. In

summary this is about paying attention to those with serious skin in the

game. This is an important subject and I have covered this in depth in

the article "Skin In The Game". I

commend Skin In The Game to you because it will show you how to benefit

from the unseen margins in other people's behaviour and save or make you

a lot of time and money.

[4] Human Laziness, Need and Greed In my experience of life in general and business in particular so many people follow their hard-wiring and take the line of least resistance to where they think the money is, and their motivation is a combination of need and greed. I accept that I may have a particularly jaundiced view because in my line of work in the fuel industry the rewards can be huge. As a consequence so many brokers that I know chase the deals and play the numbers game and largely fail because they do not know how to benefit from the unseen margins. If you want to know how to benefit from the unseen margins in any

field where there are potentially very big financial rewards do what

most other people don't do and focus on all the intangibles. In my experience, the route to the big primary currency is via deep attention and focus on the second currency. Become so darn good they can't ignore you!

The common theme in each of the following tips is to ask questions and be curious. The

following tips are questions that I have found to be useful in my

ongoing quest to learn more about how to benefit from the unseen margins

and positioning myself to be take advantage of them. This list is not exhaustive, and I suggest you use this as basis for developing a few key questions of your own. The

goal here is to be clear on those few questions and hold them in mind so

often that they become second nature to you, and then you will catch

yourself identifying unseen hidden value in everyday encounters and

interactions in your personal and working life. If you want to take this

seriously, you need to make this a habit. OK, so here we go, these are 5 questions that I use: [1] How Can I add Value To This Person Or This Situation? The subtitle to this point is: What does the other person really want and how can I help

them get it? As with each of these points, this is all about adopting a different mindset. If

you do this consistently, and over time, you will surprise yourself as

you discover how to benefit from the unseen margins in many different

and unexpected ways. This is absolutely not about

manipulating other people or taking any form of unfair advantage. This

is all about getting what we want by helping other people get what they

want. There are various ways you can look at this:

These principles also work equally well if you are seeking secondary currency in any form that is important to you.

# A public service example of someone trading in secondary currency for its own sake As

mentioned earlier our late Queen was a wonderful exponent of the use of

secondary currency. Her personal mission in life was one of duty and

service and not the pursuit of primary currency - she was one of

wealthiest women on the planet - but she wanted to make a difference in

the lives of all the people with whom she had interactions. This manifested in countless small and very personal kindnesses that she extended to very large numbers of ordinary people that she met throughout her very long life. At the other end of the spectrum and when dealing with the rich and powerful she exercised very considerable soft power. All of her actions and interactions were based on values of service

and making small and subtle differences in other people's lives. Her personal reward for all of this was the secondary currency of the satisfaction that she had served her country and her God, and fulfilled her duty. [2] How Can I Leverage This Situation For Future Advantage? This

tip is an extension of the first point. I have found in my work that as

I have made it a continuous practice to always seek to add value and

help my contacts and associates get what they want I invariably find

myself reflecting on these interactions and keeping my mind open to ways

in which I can share, help or exploit the substance of that interaction

with someone else. Put simply I ask myself: Who else do I know

who could benefit from this? In fact because I have trained myself to

think like this I now get ideas more or less automatically. Another aspect of leverage is taking the long view

and building up a large balance of secondary currency with the other

person or party such that when a suitable opportunity arises for them to

reciprocate, they do so on a far bigger scale than they might otherwise

have done. The leverage can also occur because I am building up my knowledge bank to such an extent

that I can benefit from it by identifying and developing other new

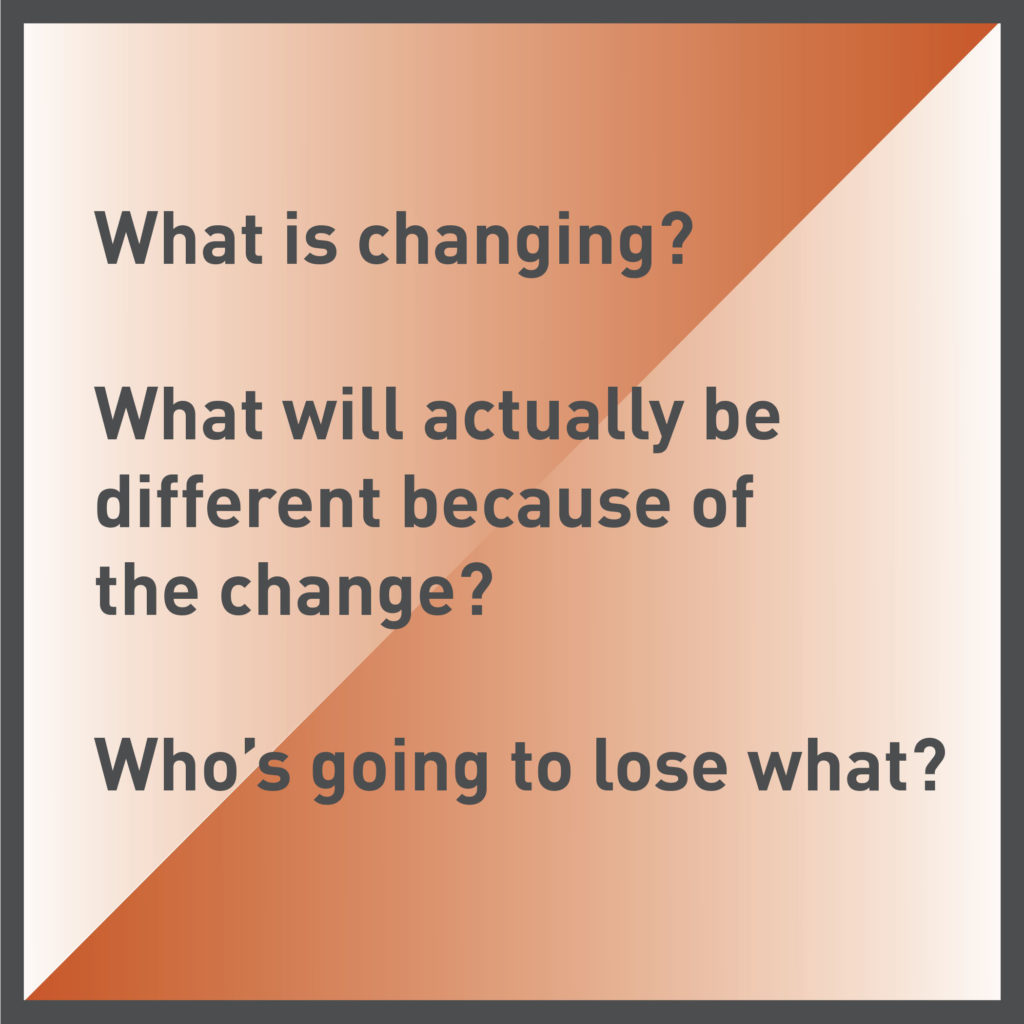

business opportunities. This is a practical example of Cal Newport's point about "being so good they can't ignore you". [3] Who Is This Affecting And How Is It Affecting Them? This tip is particularly useful when interacting with people who are being impacted by change. Some

change in life is chosen but much of it isn't and is imposed, and

there are a number of articles on this site that address this theme. [If

you are interested you can either use the index tabs in the left hand

column or use the search feature in the site map and index.] Times

of change and transition bring many opportunities and these will often

emerge through engaging with those who are being impacted, and asking

questions. # A business example of exploiting a secondary currency opportunity to generate lots of primary currency Because

I am a businessman I automatically seek primary currency in many of

my interactions with people - and especially other business people. One

of the ways I do this is by focusing on and meeting the personal needs

of my client or counter-party, in addition to focusing on their business

and organisational needs. I look closely at how they are being impacted by the situation, and I try to find out their secondary currency needs and requirements. Addressing their secondary currency needs inevitably unlocks the primary currency that I seek. On one

major IT programme that I helped run, I discovered that my client - the

programme director had a very personal agenda, he was project managing

the building of a large house for himself and his family. This

was time consuming and demanding for him. I ensured that I and my team

took much of the hassle and stress of the IT programme away from him,

and also made sure that all of the projects' milestones were hit. This enabled him to do what he really wanted to do - which was build his

house. This symbiotic relationship became very beneficial. He built his big house and I made hundred of thousands of dollars. [4] What Are They Measuring, Where Are The Gaps And What Are They Missing? This question is one I always ask myself when I encounter any form of request for data or I see some form of information gathering exercise going on, whether initiated by a central or local authority or a third party organisation. I am always curious and always like to ask questions because as with the German forest example noted above, many official information gathering or measuring exercises are based on a simplified view of a high level map and there are often gaps. It is these gaps that can yield the unseen margins. # Example of an ignored and "politically incorrect" demographic issue 25

years years my family and I were planning to move to a new area. At

that time our children were aged 10 and 13 so clearly their schooling

was an important consideration. I undertook an exercise to analyse the Ofsted reports for all the schools in the catchment area we were considering. I had been warned that all of the state funded schools in the city were poor performers with low ratings. But

on closer examination I discovered that the performance figures and the

metrics used did not take account of the single biggest issue that

affected the performance and rating of a school in the league tables. This real big issue was the demographic of the catchment area for the school. The

quality of head teachers and staff performance, and the level of "value

added" [i.e. improvement in rating of leavers compared with the rating

of intake] was universally the same as non-city schools in higher

placings on the league tables. All the schools, whether city non-city,

added 2 levels of value [or improvement]. What

was not measured or discussed were the demographic profiles and

attendant issues of social deprivation, poverty, criminality and broken

families. The effect of these social issues was to reduce the academic

performance quality of the intake from primary schools [for pupils aged

under 11]. This was the sole and obvious reason for the ostensibly poor performance of leavers [at aged 16+] from the city schools. This

was, and probably still is, such a sensitive and contentious issue that

it is not discussed in public and political debate about schools'

performance. The

focus is always on the league tables which measure how schools score

against Government/Ofsted standards and it is the head teachers and

staff who are blamed. There is no broader and societal happy ending to this anecdote. At

the personal level this analysis shaped our decision about where we

chose to live, and we played very close attention to the demographics of

the catchment neighbourhood for the local schools. [5] What Is The Bigger Picture Here - Who Stands To Gain/Lose And Why? This

is a question I always ask myself when I encounter any proposed or

enacted policy change, or major organisational, market or systemic change. # Business examples of major gains from systemic change and turbulent events At

time of writing, a current example of this is the fuel market - in

which I work. With the impact of Covid and the Russian-Ukraine war there

are major primary currency opportunities for those of us who sell fuel

and especially natural gas and liquid natural gas. A further

consequence of these factors is the 20% slide of the British pound

against the US dollar in recent months. Getting paid in dollars and

investing in pounds yields a huge tax free advantage of 20%. In

this example clearly many, many people stand to lose a lot, and in some

cases everything. But others stand to gain. This is always the case. By

playing the long game and preparing and positioning yourself for these large,

unexpected and often cataclysmic events there can be very large primary

currency rewards.

[1] Understand Your Currencies And The Relationship Between Them Just to recap, we are focused

on intangible margins which are expressed as secondary currency and are

hard to see and measure because they are value based and thus entirely

subjective. # Secondary currency into primary currency Once

we understand these margins in our personal areas of work and special

interest we can develop a good idea of how this secondary currency can

be transmuted into primary currency - and especially money. With practice this can be an extremely valuable means of enhancing your income, capital and net worth. # Secondary currency into secondary currency As

we noted above with the example of the Queen, there are many ways in

which we can trade in values based actions and activities with the

purpose of creating further and additional secondary currency. This

can, as in Queen's example, be entirely altruistic and an act of

selfless service; or it can be solely for personal or organisational

gain as expressed in the value of enhanced image, honour, reputation or

glorification. # Primary currency into secondary currency This is an interesting one and it falls into 2 quite different categories: [a] Primary into secondary currency to create further primary currency. This

is illustrated in the Costco example above where they pass on the cost

savings they make to their customers [rather than their bottom line] and

in so doing build a secondary currency value of trust. This

is in leads to customer retention and enhanced life time value of a

customer which in turn transmute back into higher sales and profits [b] Primary into secondary currency in order to avoid dilution of primary currency [at someone else's expense]. I

have a business interest in the hospitality sector in the UK and I have

done many case studies to investigate what happens when small owner

managed companies expand and become multi-site operations with the

financial assistance of private equity companies. What

I see from the outside looking in is strong branding and major

investment in the intangible assets of the business, all leading to the

opening of new sites and positive PR in the trade press and popular

press. But when I look at the

accounts, balance sheets and shareholding structures I so often find

that the private equity investors have loaded these business with high

interest payments to themselves and have diluted [taken away] most of

the founding owners' shares in favour of themselves. Sure

these "owners" have industry profile and prestige and a certain amount

of glamour which all amounts to secondary currency, but they have

deluded themselves into accepting the very considerable reduction in

cashflow and profits with the high interest payments and they have given

away most of their capital. [I have seen instances where owners have

ended up with as little of 3 to 5% of their original 50-100% stake in

the business.] This principle works

fine when you have a small and reduced share of something that is

massive, but in these cases it isn't massive. These are early stage

investments. So these guys have

allowed the investor companies to retain their capital and profits in

exchange for what often proves to be very transitory secondary

currency. Always be very careful when someone offers you lots of secondary

currency in return for your income and net worth. It happens more often

than you may think.

[2] Prepare For The Unexpected Nassim Taleb has covered this whole subject very thoroughly and I have featured his work on this site.

Antifragile is a term that he coined to represent things [or people] that benefit from

disorder.

He explains how antifragility allows us to deal with the unknown, to do things without understanding them - and do them well. Recent global events with the pandemic, the Ukraine-Russia war and the consequent fuel crisis are powerful reminders of just how uncertain life can be, and especially the unforseen side-efects of these events. He has covered this subject well and I recommend you take a look at Antifragile. Life

is more random than you think and your ability to navigate it rationally is

more limited than you think. [Nassim Taleb]

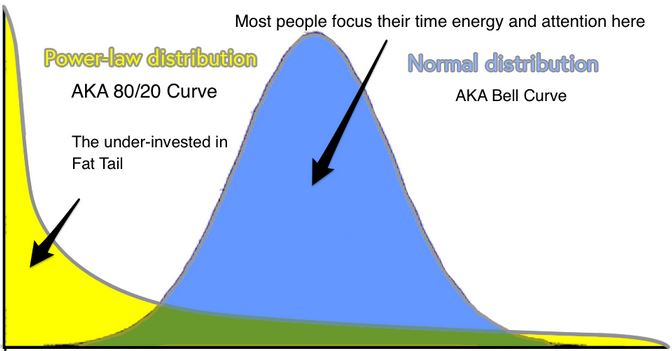

[3] Work With Probability I am sure you are familiar with the Pareto Principle aka the 80/20 rule. But you may not be so aware of the The Fat Tail Fractal Factor which is where the 80/20 rule can be

applied to itself. So

20% of your 20% best efforts [i.e. 4%] will deliver 64% of your best

results. And

the 80/20 rule can be applied to this 4% so 20% of that 4% [i.e. 0.8%]

will deliver 51.2% of your best results. In summary means less than 1% of your efforts and resources can deliver over 50% of your results. If

you can master the dynamics of making this happen you can take a

quantum leap in your personal effectiveness in any area of life that

really matters to you. “The greatest shortcoming of the human race is our inability to understand the exponential function.” [Albert Allen Bartlett]

[4] Play The Long Game [And Be prepared To Pay The Price] The long game describes an approach to any area of life that sacrifices short term gains for long-term wins. It is about having a long term goal and taking the necessary steps now to set yourself up for long term success. Please see: The Long Game "You have to be willing to look like an idiot in the

short term to look like a genius in the long term." [Shane Parish]

How To Benefit From The Unseen Margins - Defining Our Terms How To Benefit From The Unseen Margins In An Environment Of Complexity 5 Key Tips On How To Benefit From The Unseen Margins Guiding Principles On How To Benefit From The Unseen Margins Further Reading: Understanding Complex Systems Thinking - It's Not Complicated How to Get What You Value by Changing What You Measure How To Be A Winner - The Incredible Benefits Of Selective Attention The Metagame Approach To Life - How To Achieve Your Biggest Objectives Why Understanding Ergodicity Is Critical To Your Long Term Survival How Positive Asymmetry Can Transform Your Life Next Article: The Art Of Thinking Clearly - How To Do More Than Just Survive And Reproduce Return from: "How To Benefit From The Unseen Margins" To: Walking The Talk

Or to: Mental Models How To Benefit From The Unseen Margins In An Environment Of Complexity

5 Key Tips On How To Benefit From The Unseen Margins

Guiding Principles On How To Benefit From The Unseen Margins

How To Benefit From The Unseen Margins - Key Point Summary

LATEST ARTICLES

The Battle For Your Mind - How To Win Inner Freedom In A Digital Age Of Distraction

From External Events to Inner Events. We often think of “events” as things that happen out there: the traffic jam, the rude comment, the delayed email reply. But what truly shapes our experience is wh…

From External Events to Inner Events. We often think of “events” as things that happen out there: the traffic jam, the rude comment, the delayed email reply. But what truly shapes our experience is wh…How to See Your Thoughts Without Becoming the Story

A Practical Guide to Thought-Awareness. You can spend your life inside the stories of your mind without ever learning how to see your thoughts clearly and objectively. Most of the stuff we tell oursel…

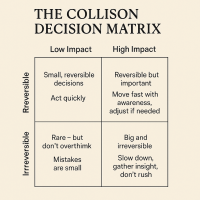

A Practical Guide to Thought-Awareness. You can spend your life inside the stories of your mind without ever learning how to see your thoughts clearly and objectively. Most of the stuff we tell oursel…The Collison Decision Matrix - A Simple Framework for Better Choices

The Collison Decision Matrix Is A Practical Everyday Thinking Tool. Most of us spend a surprising amount of time worrying about decisions. From small ones such as what to wear, what to eat, what to te…

The Collison Decision Matrix Is A Practical Everyday Thinking Tool. Most of us spend a surprising amount of time worrying about decisions. From small ones such as what to wear, what to eat, what to te…The Power Of Asking The Right Question

The Power Of Asking The Right Question Lies In The Quest For Insight. To experience the power of asking the right question you must develop the practice of asking questions. The best way to improve th…

The Power Of Asking The Right Question Lies In The Quest For Insight. To experience the power of asking the right question you must develop the practice of asking questions. The best way to improve th…Site Pathways

Here is a site pathway to help new readers of Zen-Tools navigate the material on this site. Each pathway is based around one of the many key themes covered on this site and contain a 150 word introduc…

Here is a site pathway to help new readers of Zen-Tools navigate the material on this site. Each pathway is based around one of the many key themes covered on this site and contain a 150 word introduc…How To Live With Contradiction - Beyond Thought Let Stillness Speak

A major impact on so many peoples' lives is the situational contradiction of unfilled realistic expectations. So where does all this leave us? Well here we are, with mental equipment that is more lim…

A major impact on so many peoples' lives is the situational contradiction of unfilled realistic expectations. So where does all this leave us? Well here we are, with mental equipment that is more lim…How To Trust The Process Of Mindfulness - Right Now

In mindfulness, the process isn’t some distant goal — it's what is happening right now. When we talk about how to trust the process of mindfulness the credibility of the process is heavily dependent…

In mindfulness, the process isn’t some distant goal — it's what is happening right now. When we talk about how to trust the process of mindfulness the credibility of the process is heavily dependent…Inner Mastery For Outer Impact - Mental Clarity For Effective Action

Insights only matter if they translate into consistent action. In a world crowded with quick fixes and motivational soundbites, the theme “Inner Mastery for Outer Impact” calls us to something more e…

Insights only matter if they translate into consistent action. In a world crowded with quick fixes and motivational soundbites, the theme “Inner Mastery for Outer Impact” calls us to something more e…The Wise Advocate - Helping You Achieve The Very Best Outcome

The focus of your attention in critical moments of choice either builds or restricts your capacity for achieving the best outcome. When we talk of 'The Wise Advocate' its easy to think of the consigl…

The focus of your attention in critical moments of choice either builds or restricts your capacity for achieving the best outcome. When we talk of 'The Wise Advocate' its easy to think of the consigl…Trust The Process - Beyond The Cliche

The phrase "trust the process" has become a cliche, the woo-woo mantra of the "self help" industry. Those three little words feel like they ought to mean something useful but hidden behind them are a…

The phrase "trust the process" has become a cliche, the woo-woo mantra of the "self help" industry. Those three little words feel like they ought to mean something useful but hidden behind them are a…The Dopamine Delusion - Why Anticipation Beats Achievement

The thrill we feel is not in the having, but in the wanting. The more we have, the more we want. The more things we acquire and the easier things get for us, the more discontent we feel. The more spo…

The thrill we feel is not in the having, but in the wanting. The more we have, the more we want. The more things we acquire and the easier things get for us, the more discontent we feel. The more spo…The Power Of Silence Is Experienced In Your Use Of Language

Practise the "Beneficial Neurological Delay" for optimal comprehension. The power of silence is experienced in your use of language, specifically: - How you formulate the words you use to think and in…

Practise the "Beneficial Neurological Delay" for optimal comprehension. The power of silence is experienced in your use of language, specifically: - How you formulate the words you use to think and in…

![Play The Long Game [And Be prepared To Pay The Price] Play The Long Game [And Be prepared To Pay The Price]](https://www.zen-tools.net/images/xthe-long-game.jpg.pagespeed.ic.SR3U-MQh79.jpg)